Was Covid 19 Designed to Mask and “Bailout” An Actuarially Inevitable Collapse of the US Treasury Market and Overleveraged Cartel Companies Like Boeing

There is massive evidence of “government” and bankster foreknowledge and by the exact same organizations and participants that I identified in my book “Government” – The Biggest Scam in History… Exposed! : The Council on Foreign Relations, Skull and Bones, and the same Banking, Central Banking, and pharmaceutical interests that have been profiting from “Government” and its fractional reserve banking and mandatory vaccinations. Many participants, especially Bill Gates and Bill Ackman, who made a reported $2.6 Billion in a matter of months by hedging the corona-associated economic collapse, are known eugenicists and supporters of Planned Parenthood and Cold Springs Harbor, the epicenter of the global eugenics’ movement. Bill Ackman’s Pershing Capital Partners, in addition to the aforementioned $2.6 Billion hedge proceeds seems ideally positioned to profit from foreknowledge of a long-term forced closure of mom & pop restaurants, hotels, and coffee shops. Their primary investments are reported to be the exact same chain hotels, restaurants, and coffee shops that would be guaranteed to prosper once the government has forced all the independents out of business. Chipolte, Hilton Hotels, Starbucks and Restraunt Brands International which owns Popeyes, Burger King, and Tim Hortons.

The Gates Foundation, the eugenics-oriented and Rockefeller/Facebook(DARPA)-co-founder funded Johns Hopkins Center for Health Security, and the World Economic Forum held a Corona virus simulation on October 18th, 2019 called Event 201 with participants from the CIA/National Security Council, Chinese CDC, World Bank, and many of the same corporations that stood to profit from a Pandemic Scare including Johnson and Johnson and Henry Schein were also in attendance. The event produced a series of videos that seemed to communicate the strategy and talking points to downstream government and medical industry participants around the world to engineer this as a global event.

The organized crime “Government” has been borrowing a trillion dollars a year and the Congressional Budget Office has predicted trillion-dollar deficits for the rest of the decade. The deficit in January was $32.6 Billion vs. a $9 billion surplus in 2019. Treasury Department data released in February shows the shortfall at $389.2 billion in the first four months of fiscal 2020. That’s a 25% gain over the same period last year and already about 40% of the total deficit for fiscal 2019. This seems reckless to be generous and could be interpreted as a final grab to get as much value out of the system before its inevitable collapse.

The organized crime “Government” has been running up the tax payer’s credit card by selling Treasury Bonds, Bills and Notes through a crooked “auction” process run by 24 “Primary Dealers” that include the usual suspects benefiting from fractional reserve banking, the TARP/TALF and “Bailouts”, and selling the country’s debt among other financial shenanigans. I.E. Goldman Sachs, JP Morgan, Barclays, Citigroup, etc.

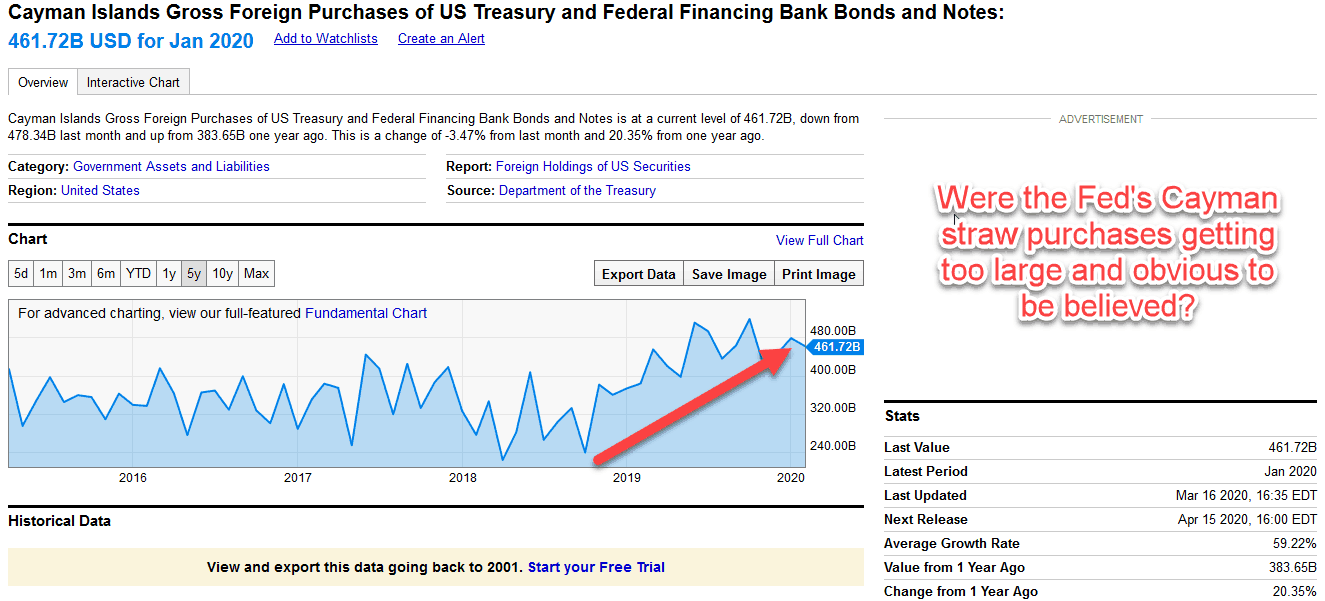

The US Treasury market has seen evidence of “Strawman” purchases for years, notably in 2014 when the country of Belgium with a population of 11M and a GDP of $484 billion at the time amassed $141 Billion in treasuries in a three-month period. Here is an article written by Paul Craig Roberts, Former Assistant Treasury Secretary under Ronald Reagan and former Wall Street Journal editorial page editor describing that piece of Federal Reserve / Treasury deception. The Cayman Islands, a hedge fund hub, is holding $460 Billion in treasuries as well with speculation that Fed-associated hedge funds are making straw purchases as well. The key take-aways are that there is evidence that the organized crime “government” has gotten itself into positions of not being able to legitimately finance its deficit spending causing it to frequently resort to straw purchases. My speculation is that the dramatic increase in the deficit over the past year, either from reckless spending or a final grab before the game is up, has led to a situation where there was simply no way to hide the massive multi-billion dollar straw purchases from other market participants and the Fed was to the point of having to step in openly and purchase treasuries directly from the Primary Dealers, which they were indeed caught doing in December, January, and February as outlined below. This action was and is a signal to market participants that the “Government” and Fed are and have been lying to the population about the true state of the economy, debt, interest rates, and that the Fed is now OPENLY and UNDENIABLY breaking the law (Federal Reserve Act) that prohibits it from monetizing the debt which is inflationary and steals the purchasing power from Americans and foreigners who have earned and saved dollars.

Why Would Investors Be Piling Hundreds of Billions into “Investments” that Yield Less Than the Rate of Inflation run by Proven Liars breaking their own Charter who are running a $23 Trillion Dollar Debt with between $75-200 Trillion+ in Unfunded Liabilities?

In November and December 2019 and in January 2020, the Federal Reserve, which is prohibited by law from purchasing treasuries at auction was caught repeatedly buying treasury bills from the primary dealers just days after their auctions.

Here is Chris Martenson’s breakdown

“It’s now clear that something spooked the Fed badly in September.

We still don’t know what exactly went on, but the Repo market[1] blew up. While this was a clear sign that something big was amiss, the Fed has not yet explained what the cause was, who needed to be bailed out, or why.

And it’s not going to anytime soon. It recently announced that its records on the matter are going to be sealed for at least two years[2].

Whatever’s going on has been serious enough for the Fed to openly lie. And not just in regards to the repo market.

“It’s not QE!” Fed chair Jerome Powell recently declared upon relaunching an asset purchase program that has already expanded the Fed’s balance sheet by hundreds of billion of dollars. (EdlB2 Note: Now Trillions!)

Given all the secrecy, obfuscation and lies, the Fed is now in clear violation of the spirit of the Federal Reserve Act of 1913.

Recall from above that the Fed “only buys Treasury securities in the open market”, meaning from other banks and financial institutions. That’s how the Federal Reserve Act of 1913 is written:

Let’s walk through an example that connects the dots here.

Just know that this is but a single example out of many.

Data point #1

Each and every Treasury offering comes with an identifying number called a “CUSIP” number (referring to the Committee on Uniform Securities Identification Procedures).

On October 31st, 2019 the Treasury Department held an auction for a series of 8-week T-bills with the CUSIP number 912796WL9.

November 5th, 2019 those T-bills were “issued”, meaning that was the actual date that they were to become active. Before that date, nobody had possession of them and nobody was earning interest on them:

From the Treasury Offering Announcement above, on November 5, 2019, $40 billion of CUSIP number 912796WL9 were issued to the market.

It’s worth pointing out that no money changes hands on auction day (Oct 31 in this instance). It only does when the bills are issued (Nov 5 in this case).

Data point #2 Looking at the Federal Reserve’s website, we can see what they bought and when (but not for how much).

There we find that very same T-bill with the CUSIP 912796WL9 showing up as having been purchased by the Fed Nov 5, 2019 — the very date of its issuance:

The Fed bought more than $4 billion of this CUSIP. If these T-bills were out in the “open market” they weren’t there for long. At most, less than a day before the Fed scooped them up.Does it really matter if a big bank sits ever-so-briefly between the Fed and the Treasury debt it buys?

Maybe to a trial lawyer seeking to get a guilty client off on a technicality. But this certainly doesn’t qualify as “old” paper.

This is the Fed buying huge amounts of very freshly minted – not even a day old! – government paper using the power of its electronic printing press.

What’s the practical difference between the Fed buying this directly from the US government and buying it same day it issues from a big bank?

Virtually nothing — except the big bank probably took home a very hefty paycheck for conducting this “service” as a middleman. Later JP Morgan, et al., can report magnificent “profits” from their ”trading activities”, which amounted to little more than calling the Fed the week before and asking how many $billions of these Treasury bills they wanted.

Just a temporary middleman who, if only skimming a single basis point (1/100 of a percent), would have gotten $400,000 in “trading profits” for holding onto a big pile of government paper for less than a single day, with a guaranteed buyer with infinitely deep pockets already lined up. Great work if you can get it, eh?

But not very fair. Nor even remotely in line with the spirit of the Federal Reserve Act. Or what capital markets are supposed to be about. Or the Fed’s actual mandate.

The summary here is this: the Fed is buying US government paper on the day it’s issued.

The Fed is directly monetizing US debt.”

December 19th, 2019 Purchases by the Fed from Primary Dealers: bought $7.5Billion in T-Bills from dealers that had “bought” them at the auction three days prior. Evidence in Addendum Documents

January 3rd 2020 Purchases by the Fed from Primary Dealers: UB3 (due July 2, 2020) which was the most active CUSIP, with $5.245BN purchased by the Fed, and TM1 (due April 2, 2020) of which $1.2BN was accepted. Evidence in Addendum Documents